Growth Suite: Client Payments

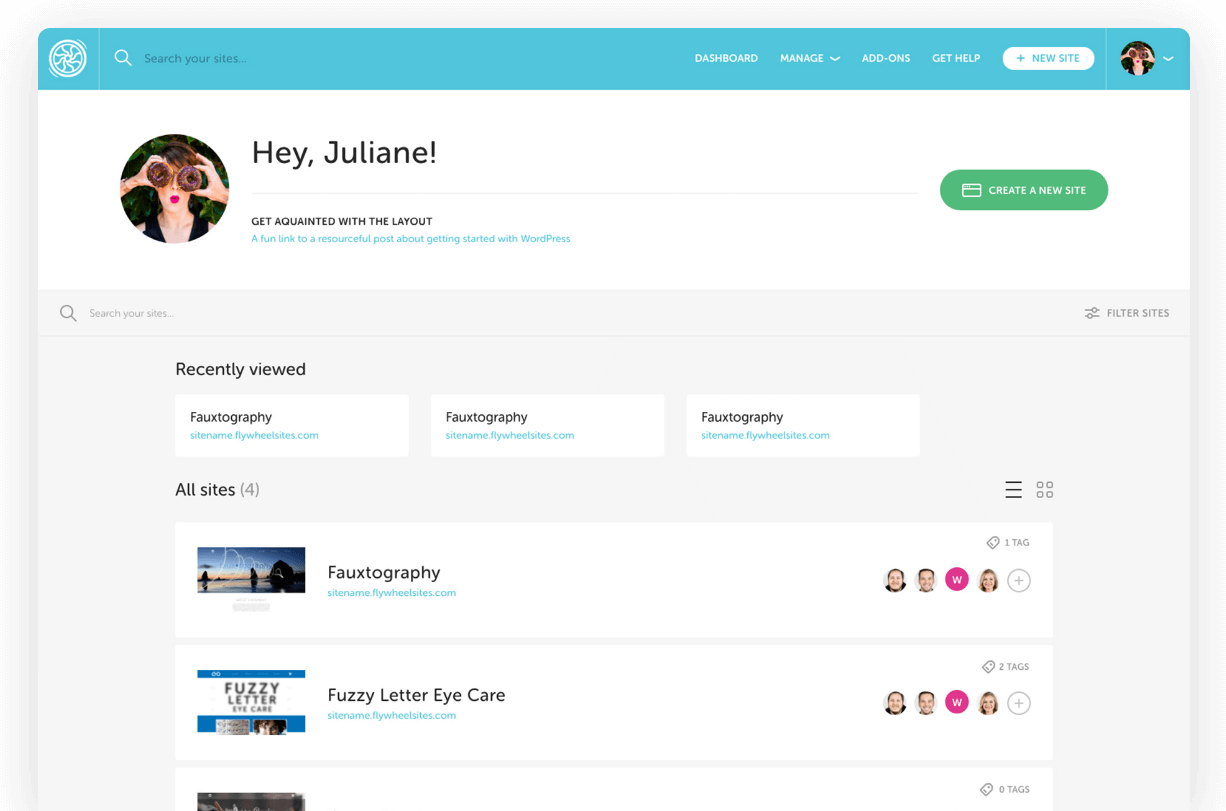

Creating a consistent and reliable payment structure for your client is a great business practice. Growth Suite allows you and your clients to manage payment methods directly from the dashboard or the Client Portal.

Note

While you have the ability to add payment methods (credit or debit card) on behalf of your client, the client will always need to approve the initial payment themselves.After a client accepts a pending subscription’s invoice, the client’s payment method on file will be automatically billed on that due date for as long as the subscription remains active.

Table of Contents:

Manage client payment methods

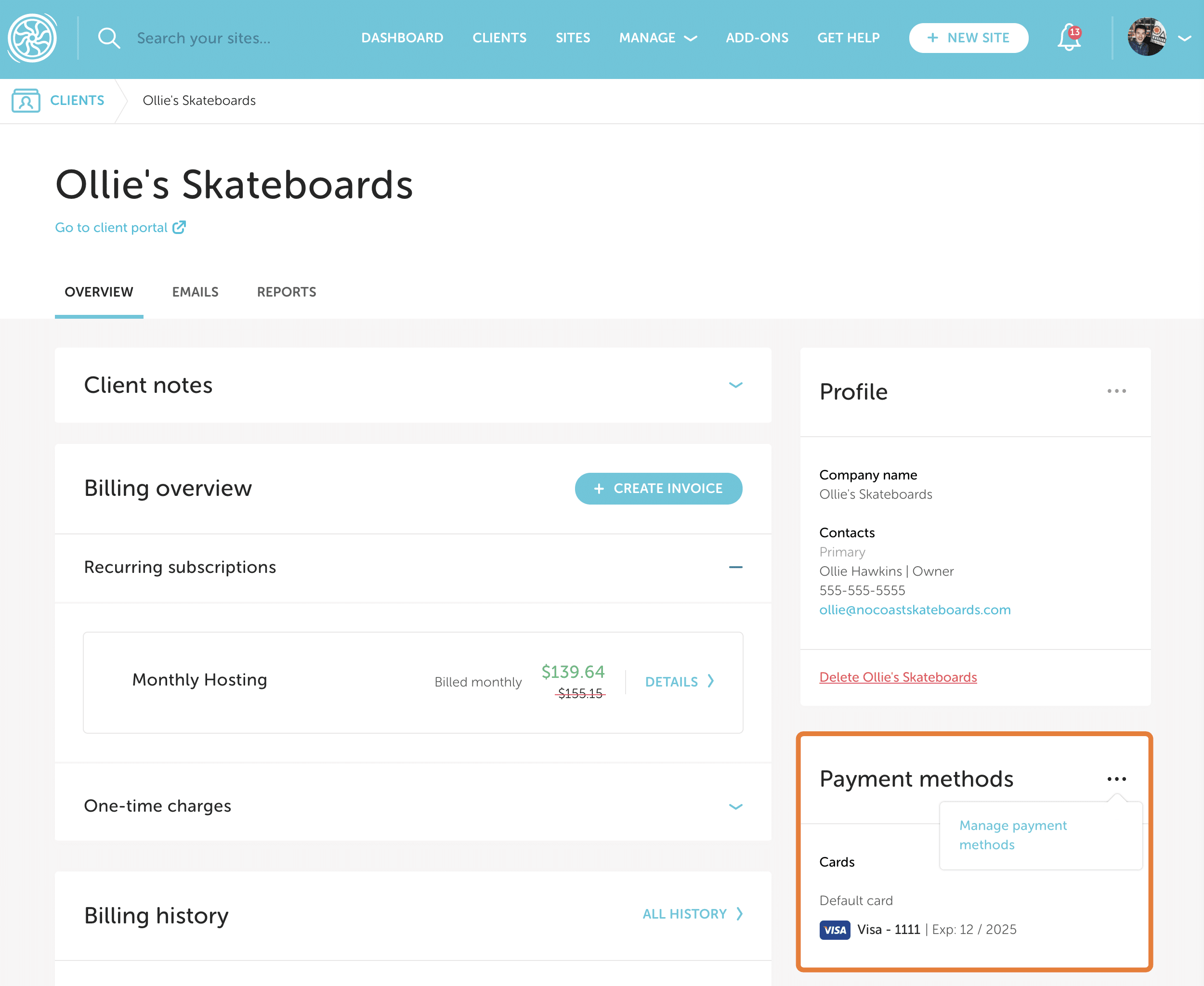

Both you and your client have the ability to update payment methods on file. Once a payment method is set up it can be automatically charged for recurring revenue.

- From your client’s individual page in the Flywheel app, you can view and manage payment methods from the Payment methods card.

Note

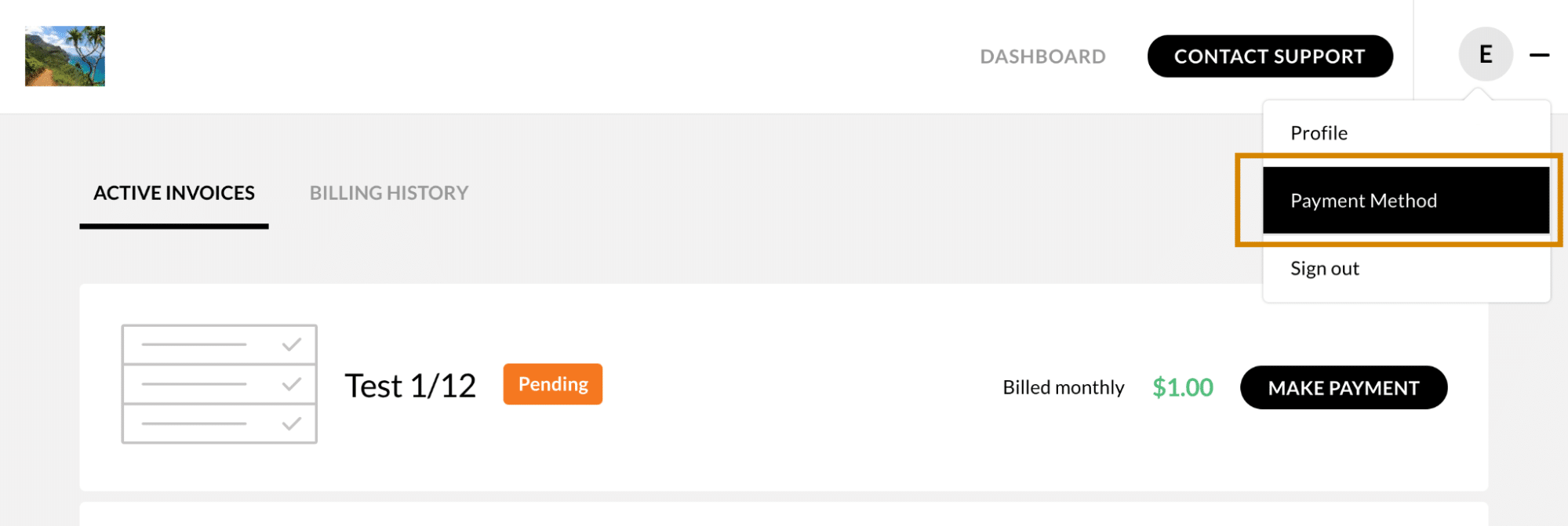

You cannot remove a payment method that is associated with an active subscription. Your client must log in to the client portal and assign a different payment method to the active subscription first. - Your client can update their payment method via the Client Portal by selecting the Payment Method option from the dropdown menu.

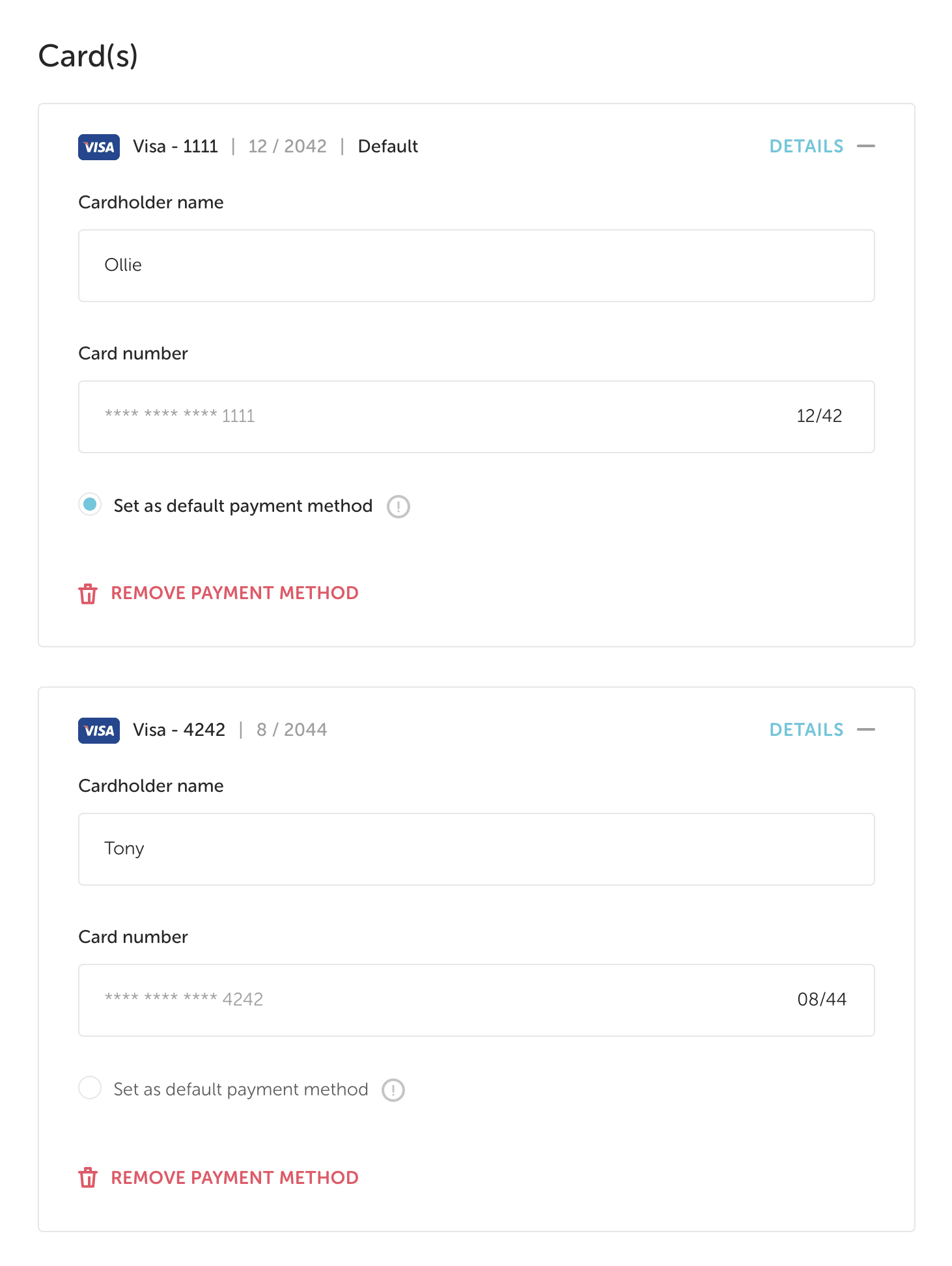

Default payment methods

You or your clients have the ability to denote a payment method on file as a default payment method. The default payment method will be auto-filled for all future payments and will not be applied to any active subscriptions.

Failed Payments

You set up your client’s monthly subscription a year ago, and thus far everything has gone swimmingly. The charges successfully go through each month, and you get paid on time!

But what happens when a payment doesn’t go through? Growth Suite has an automated workflow in place to get you paid.

What happens when a charge attempt on an active monthly subscription fails?

In this case, emails are sent to both you and the client notifying you of the failure, and the invoice is put into an Unpaid status.

Then, Stripe goes into Smart Retries mode. Here’s how Smart Retries mode works:

- Using machine-learning technology, Stripe determines the best time for the next attempt to be successful. This is made up of 4 charge attempts over a 3 week period. If one of these succeeds. Fantastic! The client is paid up.

- Every time an attempt fails, Growth Suite notifies both you and the client.

- If all 4 attempts in the 3-week period fail, then the subscription goes into Failed status (meaning “uncollectable”).

- At this moment, we create a new Pending invoice (with all the same details), ready for you and the client once they finally take action on getting the card updated.

- Our system is NO longer attempting charges for this Pending invoice. It is now in the hands of you and your client to both get their payment method updated and to accept the “new” subscription.

What happens if my client (or I on behalf of the client) uploads a new payment method during the Smart Retries period?

We will update the payment method and automatically try to collect payment on the past due amount. Whether the payment fails or succeeds, you and your client will receive an email notification.

In the event that your client has more than 1 unpaid invoice, we will attempt the charge on all invoices upon upload of the new payment method. If the payment method is accepted, then all invoices will go into Paid status. If the payment method is not accepted, Smart Retries will continue.

ACH transfers with Growth Suite

When you send an invoice to a client in Growth Suite, they can either submit payment to you via credit/debit card or the Automated Clearing House (ACH) Network – commonly referred to as a bank transfer or ACH transfer.

There are some clear benefits when your clients use ACH transfers, let’s dive in below.

Note

You can only accept funds from your clients in US dollars from US bank accounts. In addition, your account must have a US (USD) bank account to accept ACH payments.What is ACH?

ACH transfers are a way to move money between accounts. ACH transfers are electronic, bank-to-bank money transfers processed through the ACH Network. They are a cost-effective and simple payment solution that reduces potential barriers for your customers to pay via credit card.

Learn more from Stripe’s ACH guide.

Why ACH?

The biggest benefit of your clients paying you via ACH over credit/debit card is that the fees are .8% capped at $5 (as opposed to payments via credit/debit are 2.9% with no cap). Learn more about the benefits of ACH (including tips on how to get your clients to pay via ACH).

How do my clients pay via ACH?

Once you create and send off an invoice (either recurring or one-time), your client will be prompted to create a client portal account. Once created and logged in, they will be able to review the pending invoice details. At this point, they will be able to add a payment method on file (and in turn, pay the pending invoice).

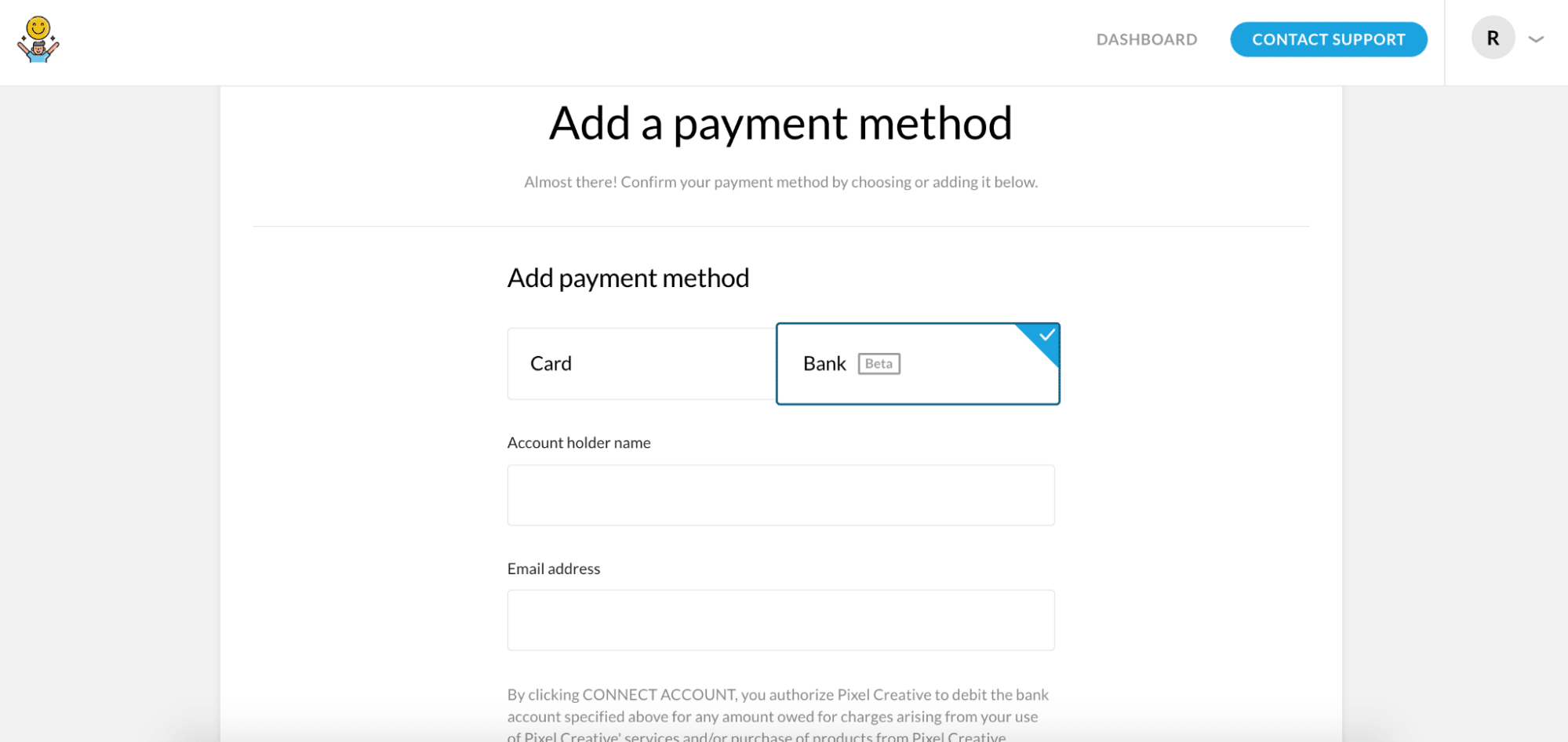

- Here you’ll see they have the option of adding a card or bank account. To set up ACH payments, they must select Bank, and provide the account holder’s name and email address.

Note

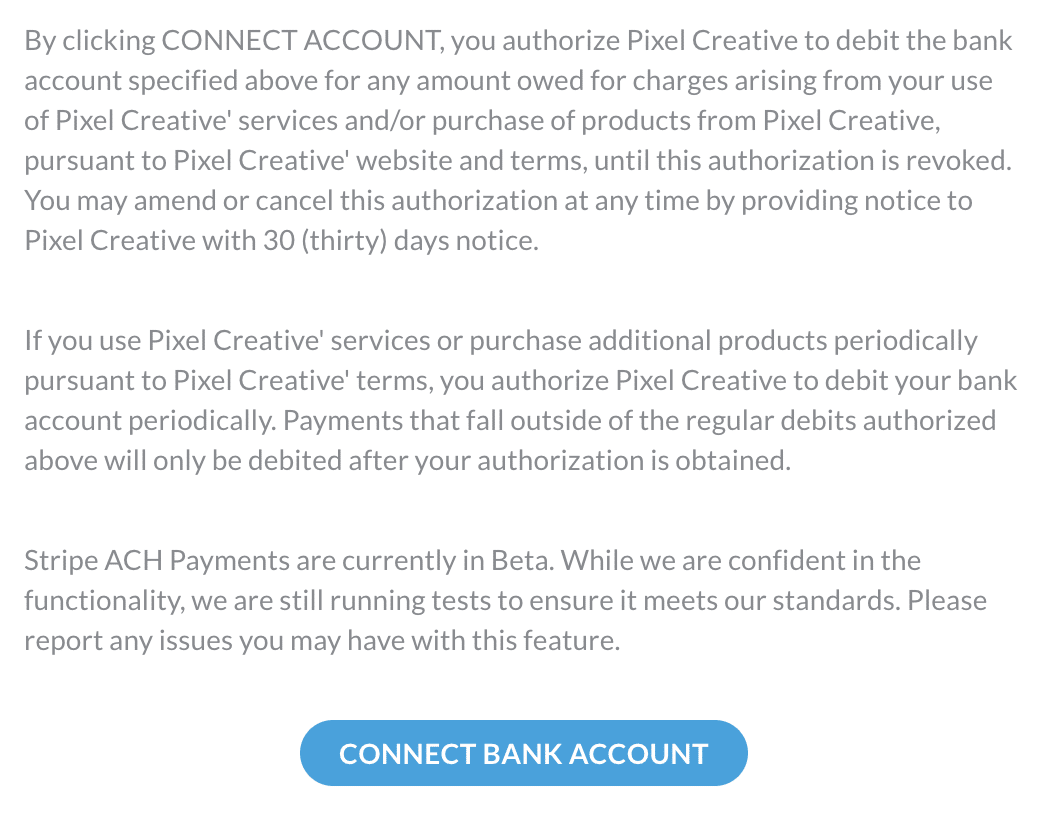

Only your clients can set up ACH payment methods. You’ll still be able to add credit/debit cards on their behalf, but the clients must authorize and set up the ACH connection on their own through the client portal. - Before clicking “Connect Bank Account”, your client will be presented with the following mandate:

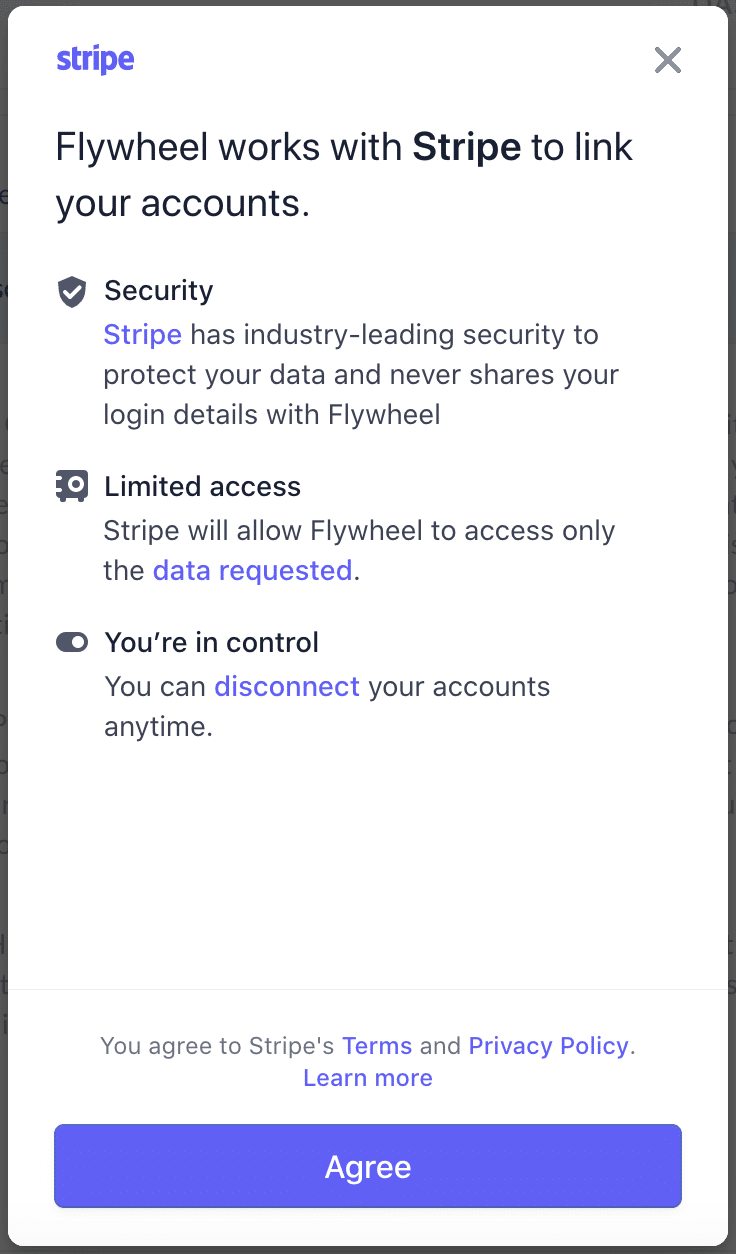

- After clicking “Connect Bank Account”, your client will need to agree to the following:

Note

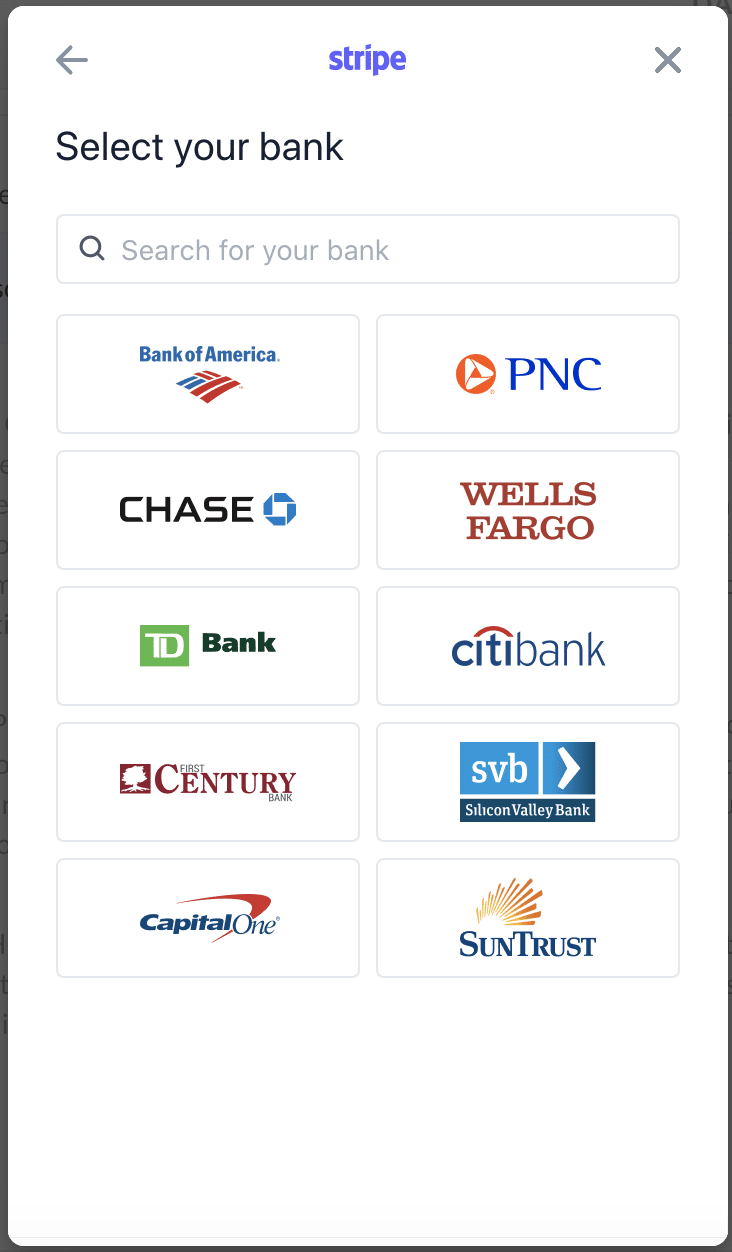

There is fine print displayed during ACH setup which lists Flywheel as the originator of the Stripe link. - Your client can then search for and select their bank.

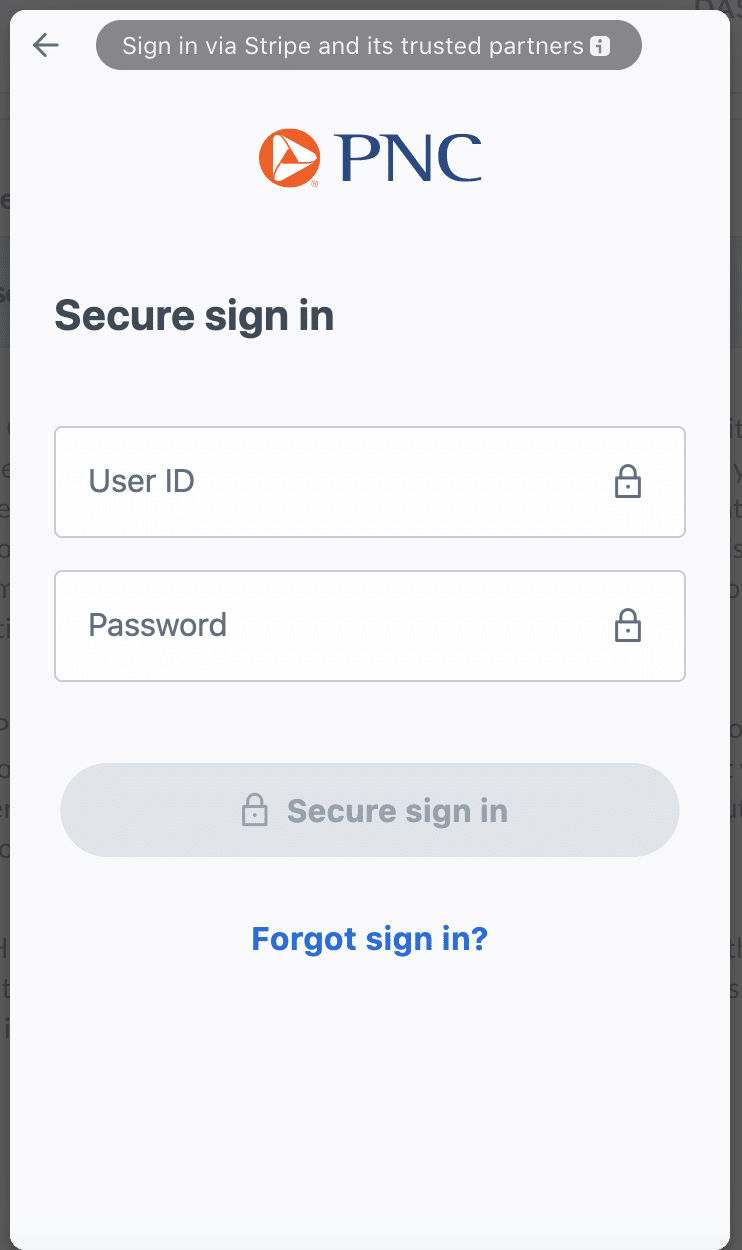

- Your client can then log into their bank.

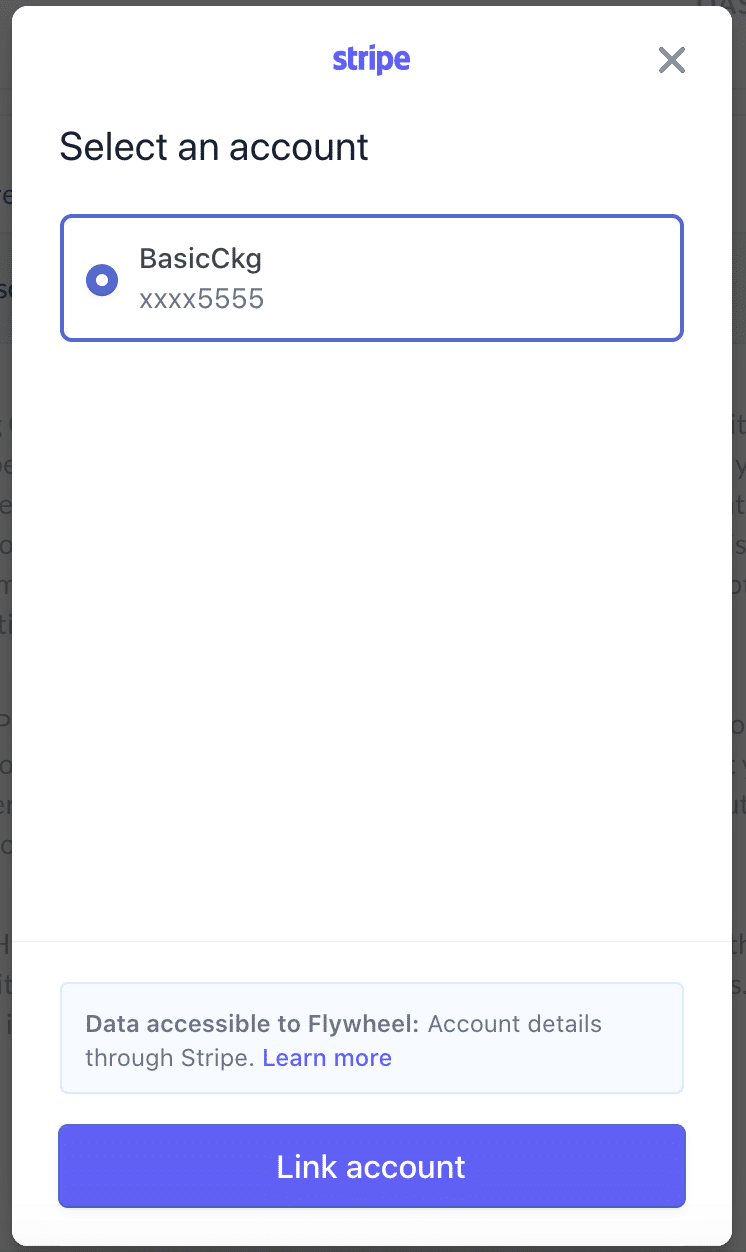

- From here, your client can select the bank account they want to set up for ACH bank transfers.

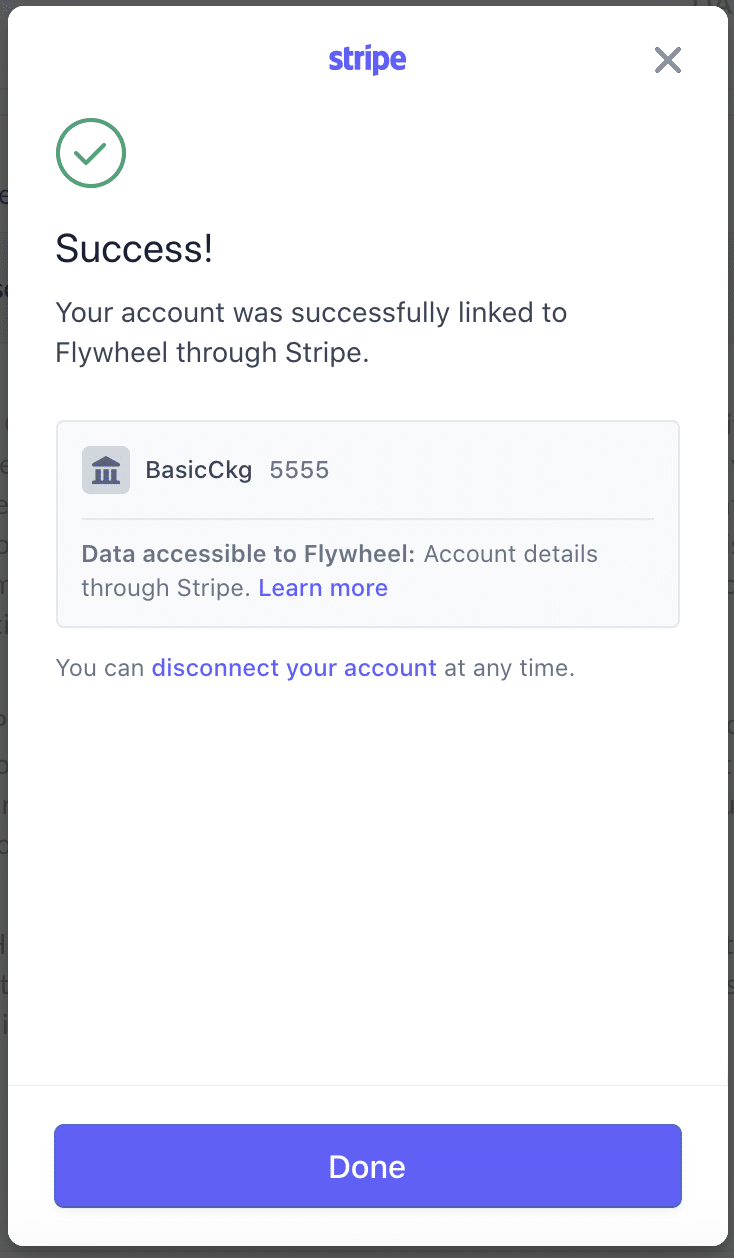

- Using Stripe’s Instant Verification, the connection will either succeed or fail.

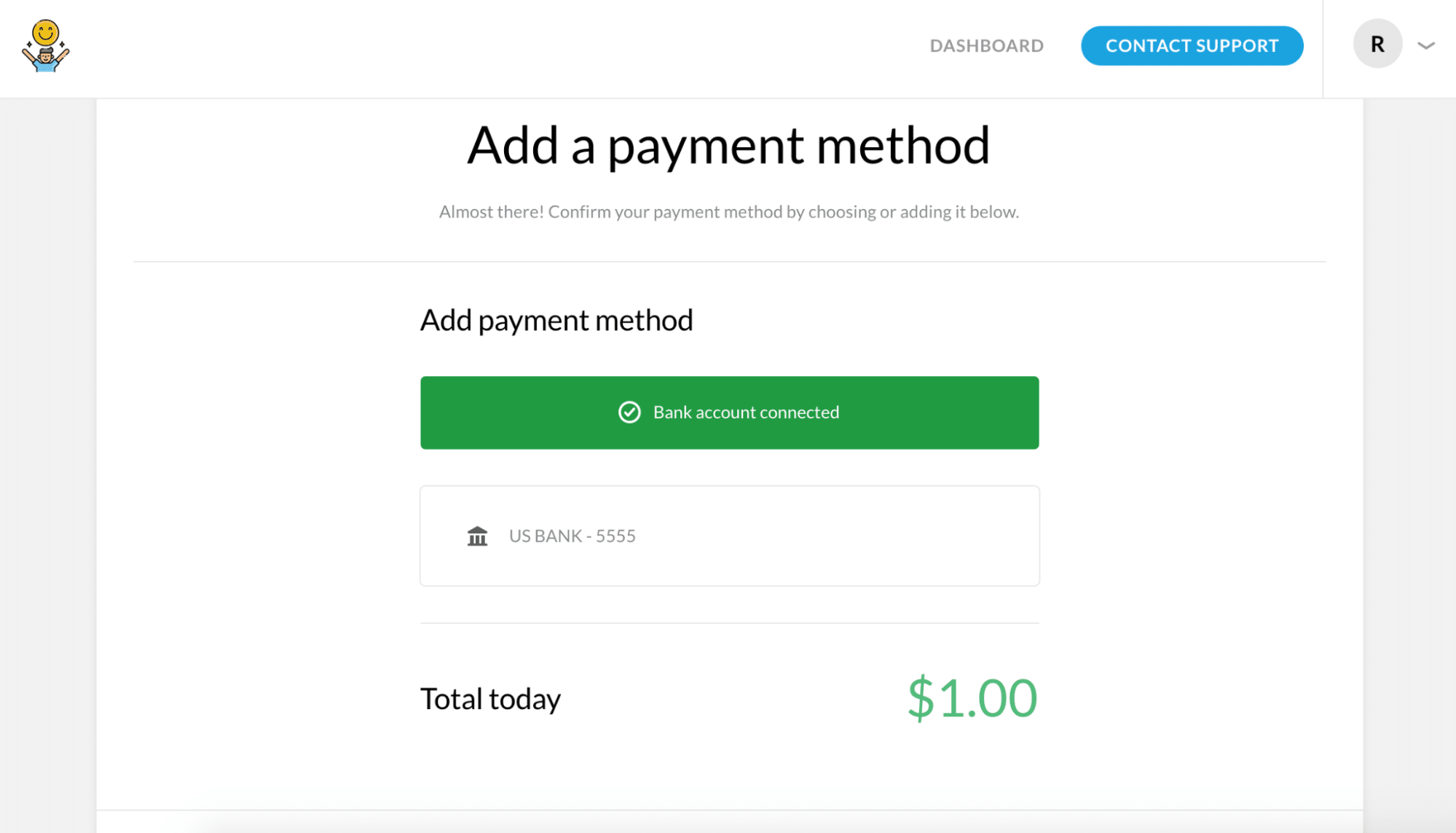

- Upon successful completion, your client will now see the connected bank account as an active payment method in the client portal.

Note

ACH payments take up to 5 business days to receive acknowledgment of their success or failure. Because of this, your Stripe balance takes up to 7 business days to reflect ACH payments in your available Stripe balance.

Need help?

If you have any questions get in touch with your Account Manager or reach out to Flywheel’s support team, we’d love to help!

Getting Started

New to Flywheel? Start here, we've got all the information you'll need to get started and launch your first site!

View all

Account Management

Learn all about managing your Flywheel user account, Teams and integrations.

View all

Features

Flywheel hosting plans include a ton of great features. Learn about how to get a free SSL certificate, set up a staging site, and more!

View all

Platform Info

All the server and setting info you'll need to help you get the most out of your Flywheel hosting plan!

View all

Site Management

Tips and tricks for managing your sites on Flywheel, including going live, troubleshooting issues and migrating or cloning sites.

View all

Growth Suite

Learn more about Growth Suite, our all-in-one solution for freelancers and agencies to grow more quickly and predictably.

Getting started with Growth Suite

Growth Suite: What are invoice statuses?

Growth Suite: What do client emails look like?

Managed Plugin Updates

Learn more about Managed Plugin Updates, and how you can keep your sites up to date, and extra safe.

-

Restoring Plugin and Theme Management on Flywheel

-

Managed Plugin Updates: Database upgrades

-

Managed Plugin Updates: Pause plugin updates

Local

View the Local help docs

Looking for a logo?

We can help! Check out our Brand Resources page for links to all of our brand assets.

Brand Resources All help articles

All help articles