Charges for US sales tax on Flywheel

Note

Information in this communication does not constitute tax, legal, or other professional advice. If you have questions, please contact your tax, legal, or another professional advisor.As a software-as-a-service and hosting company, different tax rules may apply to your final checkout total depending on the services/products you are purchasing or where you/your business are located. Let’s dive into the details.

FAQs:

- Why is Flywheel collecting sales tax?

- Does sales tax apply to me?

- Which Flywheel products/services may be subject to sales tax?

- Which US states require Flywheel to collect sales tax?

- How does Flywheel calculate sales tax?

- How do I update my billing address?

- How do I provide a Tax Exemption Certificate?

Why is Flywheel collecting sales tax?

The 2018 U.S. Supreme Court decision in South Dakota v. Wayfair changed a long-standing physical presence rule. States can now require businesses to collect sales tax on out-of-state sales if certain sales thresholds are met. So while Flywheel or WP Engine may not have been required to collect sales tax in your state in the past, this requirement has changed.

Does sales tax apply to me?

We calculate and collect sales tax based on your billing address. If you’re in a state or jurisdiction where our products or services are taxable, your bill total will include sales tax.

You can find or update your billing address by following the steps below.

Which Flywheel products and services may be subject to sales tax?

- Subscription fees

- Transaction fees

- Service fees

- Support fees

This may include products and services such as hosting, Add-ons, Paypal transaction fees, etc. Sales tax calculations and the product or service it applies to depend on the state or jurisdiction you reside in. If you have any other questions, feel free to contact us at [email protected].

Which US states require Flywheel to collect sales tax?

- Connecticut (CT)

- Hawaii (HI)

- Ohio (OH)

- South Dakota (SD)

- Texas (TX)

- West Virginia (WV)

In quarter one of 2021, we’ll be collecting sales tax that applies to customers in the states listed.

We will continue to share updates on timelines and may add other jurisdictions as they become applicable in the future.

How does Flywheel calculate sales tax?

Any applicable sales tax for your organization is calculated based on the billing address we have on file. Sales tax rates vary by state/jurisdiction.

Note

If you don’t believe the address on your last bill is correct, please update it. Details on how to do so are in the next section!How do I update my billing address?

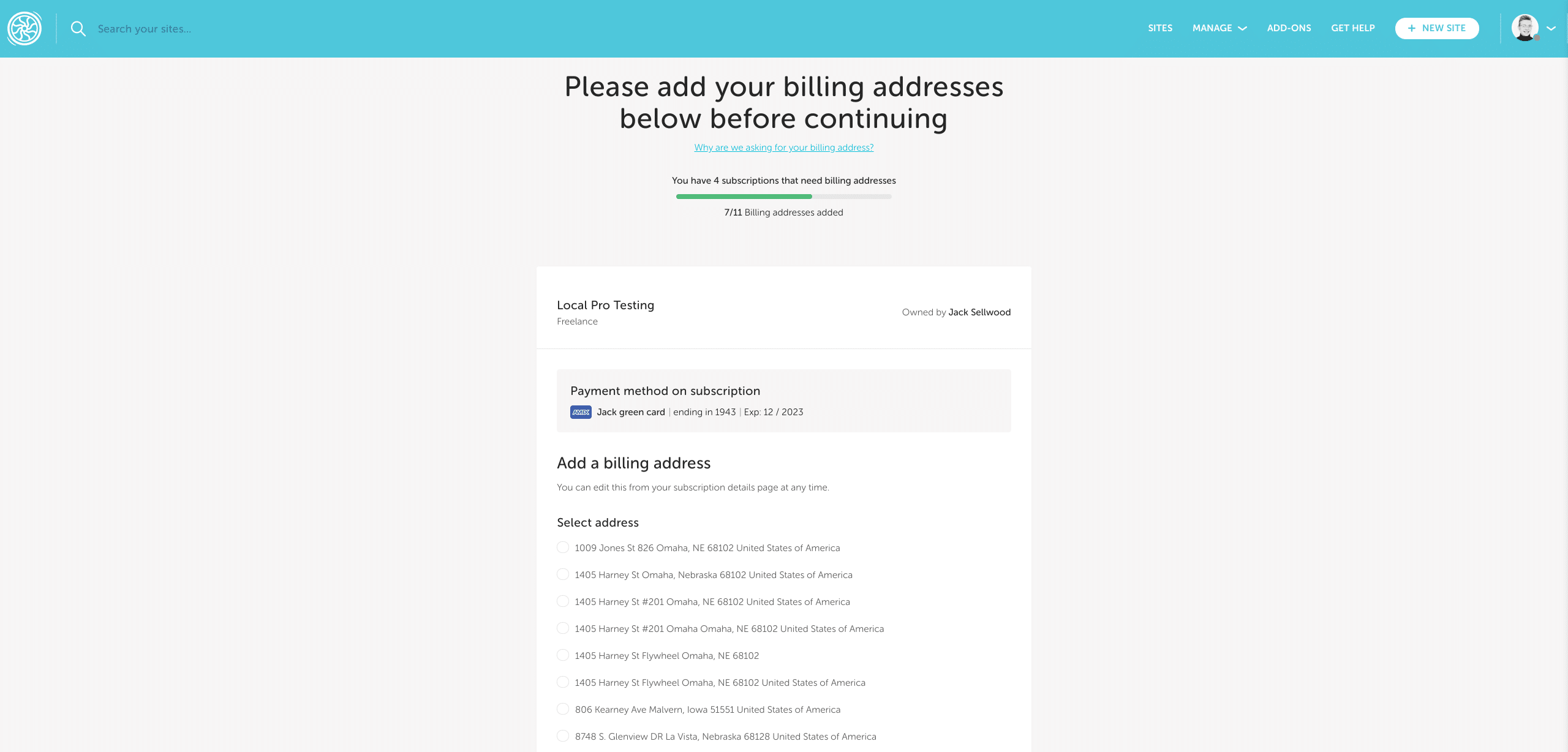

Because sales tax is calculated based on your billing address, we need the most up-to-date address on file. You can update it with the following steps:

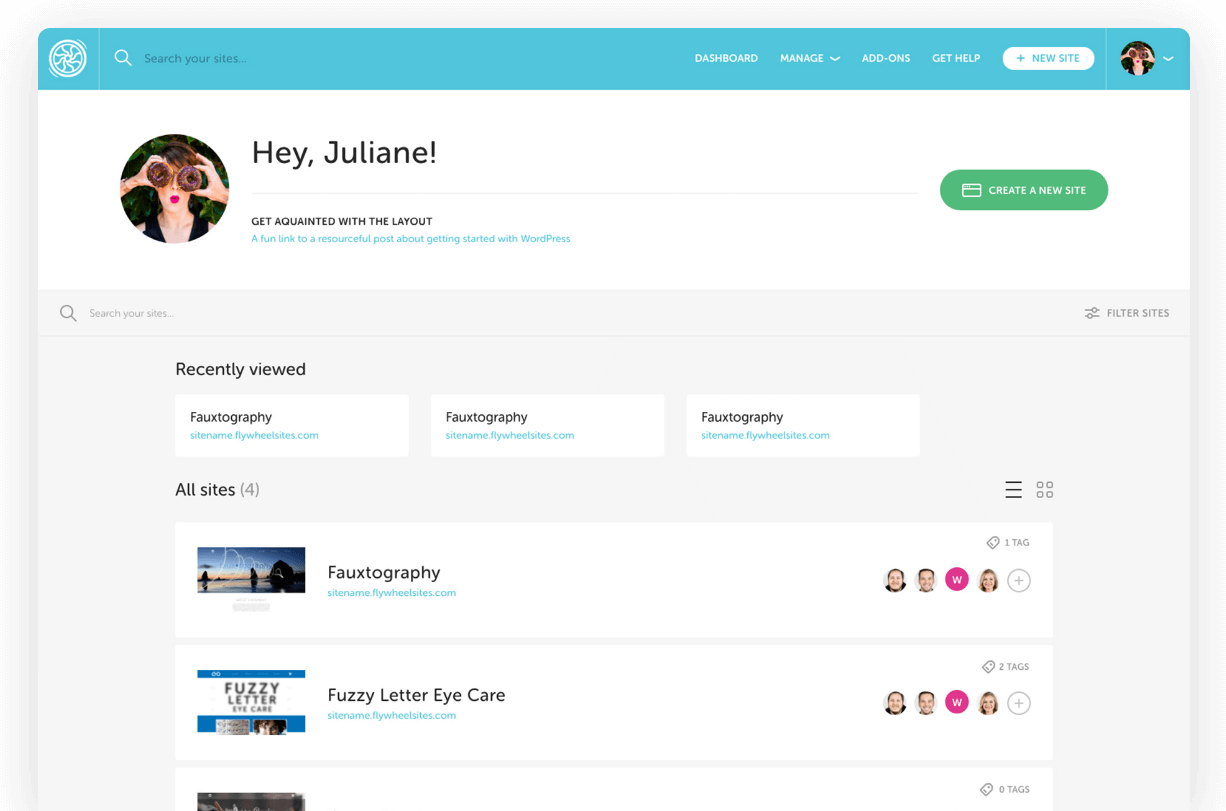

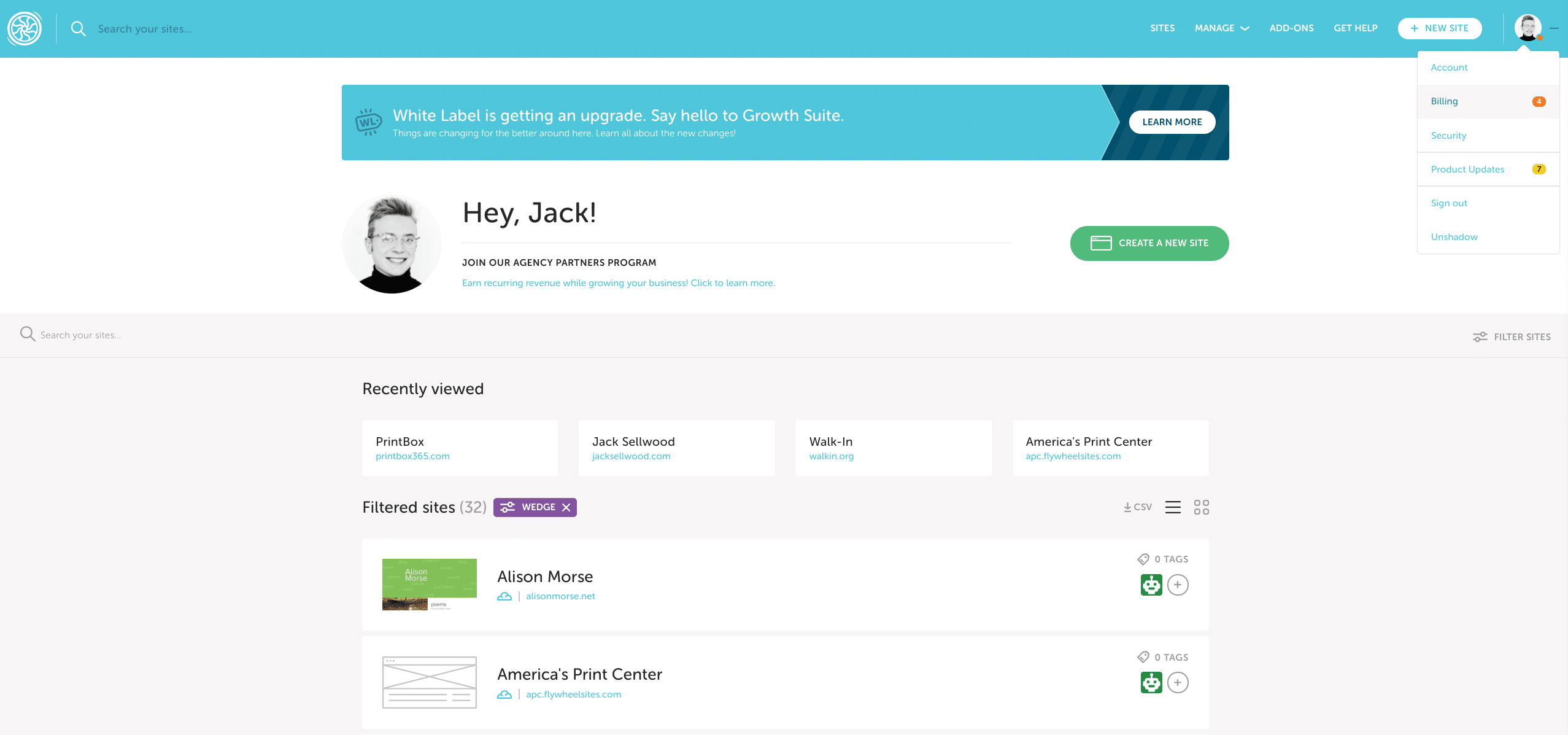

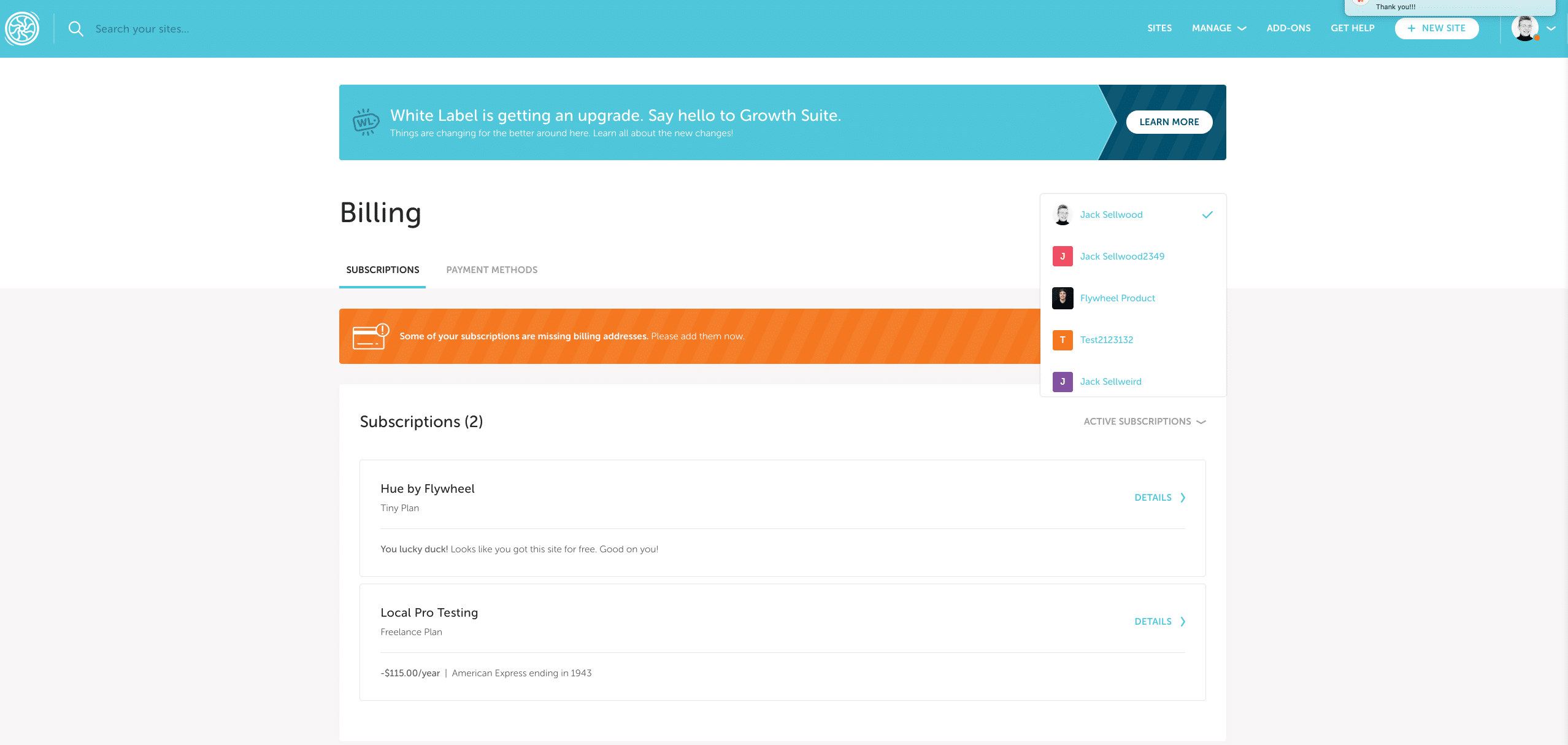

- Log in to your Flywheel account and hover your profile image in the top-right corner. Select “Billing” from the drop-down menu.

Note

If there is a missing or incomplete address, you may see an alert asking you to update the billing address of your subscription(s).

Note

If you need to update the address or information for your Organization, click your name and select the Organization you wish to make changes to from the drop-down.

- To update your address, choose your subscription, verify the information is correct or add your address, and click save.

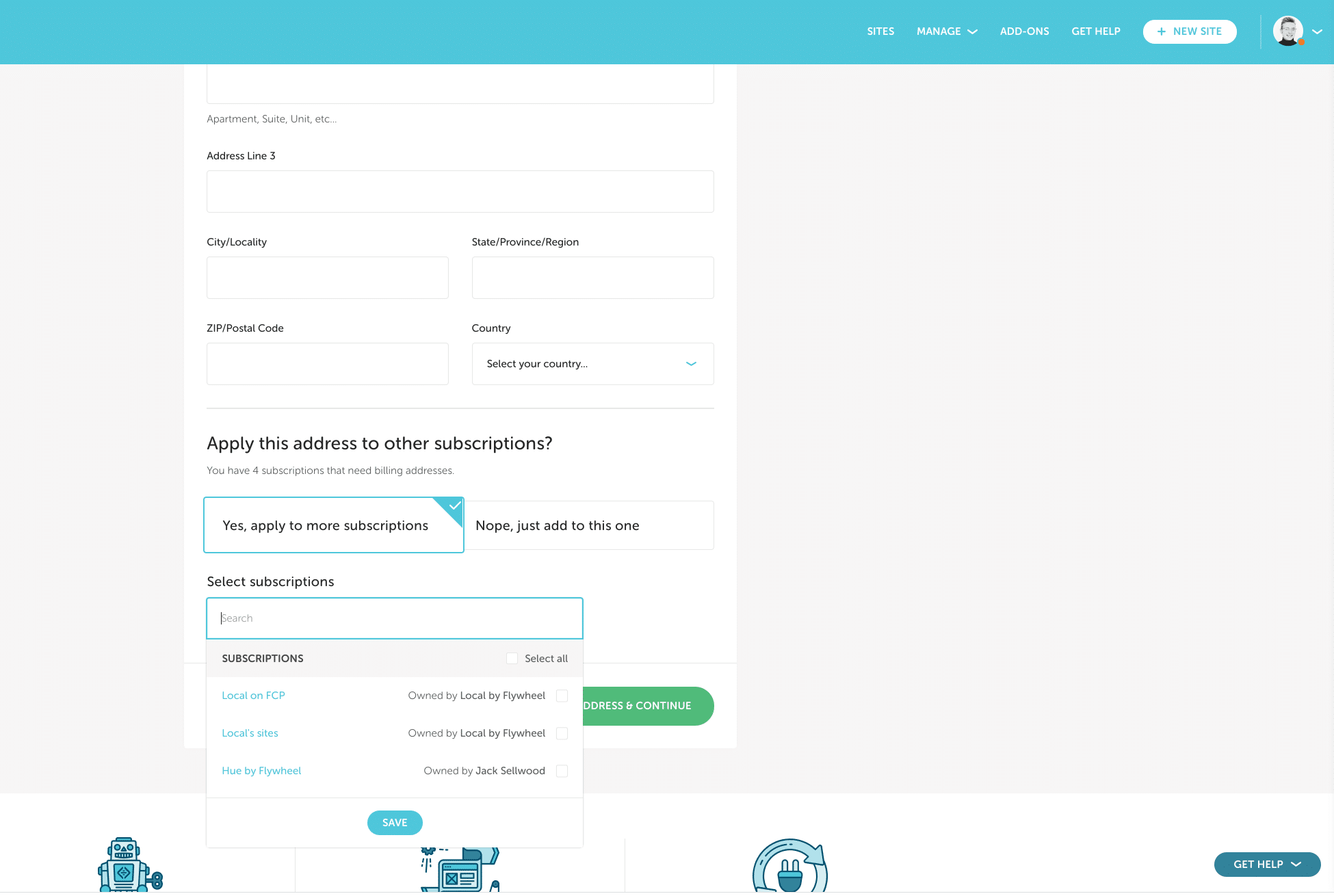

- If you would like to save the address to multiple subscriptions, select “Yes, apply to more subscriptions” and select all that apply.

Note

If you do not see the message above, go to your billing page, click “Details” next to the subscription name, and click “Edit address.” Add your billing address and click “Update billing address.”

How do I provide a tax exemption certificate?

Please send a copy of your completed exemption certificate to [email protected]. Upon receipt, we will review your certificate to ensure it’s valid. Once accepted, we will not apply sales tax to future invoices.

Need help?

If you have any questions our Happiness Engineers are here to help!

Getting Started

New to Flywheel? Start here, we've got all the information you'll need to get started and launch your first site!

View all

Account Management

Learn all about managing your Flywheel user account, Teams and integrations.

View all

Features

Flywheel hosting plans include a ton of great features. Learn about how to get a free SSL certificate, set up a staging site, and more!

View all

Platform Info

All the server and setting info you'll need to help you get the most out of your Flywheel hosting plan!

View all

Site Management

Tips and tricks for managing your sites on Flywheel, including going live, troubleshooting issues and migrating or cloning sites.

View all

Growth Suite

Learn more about Growth Suite, our all-in-one solution for freelancers and agencies to grow more quickly and predictably.

Getting started with Growth Suite

Growth Suite: What are invoice statuses?

Growth Suite: What do client emails look like?

Managed Plugin Updates

Learn more about Managed Plugin Updates, and how you can keep your sites up to date, and extra safe.

-

Restoring Plugin and Theme Management on Flywheel

-

Managed Plugin Updates: Database upgrades

-

Managed Plugin Updates: Pause plugin updates

Local

View the Local help docs

Looking for a logo?

We can help! Check out our Brand Resources page for links to all of our brand assets.

Brand Resources All help articles

All help articles